Top News

U.S. Treasury Secretary Scott Bessent disclosed that Washington and Beijing have sketched out a “framework” to keep TikTok alive in the U.S., with Trump and Xi set to bless the deal on Friday. CNBC has more here.

China just ruled that Nvidia’s $7 billion Mellanox acquisition violated antitrust law, a move with no immediate penalties but plenty of ominous implications as Washington and Beijing continue to spar over chip exports and tariffs. TechCrunch has more here.

Buoyed by a favorable ruling in its antitrust case, Alphabet has surpassed $3 trillion in market cap, becoming the fourth member of the club alongside Nvidia, Microsoft, and Apple. TechCrunch has more here.

Table of Contents

Sponsored By …

Private investors: Stuck in Excel hell? If organizing numbers takes more time than analyzing them, PortfolioIQ is your way out.

It pulls metrics from decks, spreadsheets, and emails into one clean, auditable view. Track actuals, estimates, and restatements with every number tied back to its source.

Leading funds already save 500+ hours a year with PortfolioIQ.

The 9 Most Sought-After Startups From YC Demo Day

By Marina Temkin

Y Combinator hosted its Summer 2025 Demo Day last week, showcasing the latest batch of over 160 startups.

As with recent batches, the majority of startups presented AI-centric solutions. However, a clear evolution was evident. Instead of “AI-powered” products, many companies are now building AI agents or the infrastructure and tools needed to develop them. For instance, this batch had a flurry of voice AI solutions and new businesses focused on helping others monetize the “AI economy” with ads and marketing tools.

We spoke with a handful of YC-focused investors to learn which startups they found most interesting and which generated the highest investment demand.

Below are the most frequently mentioned ones:

What it does: Stripe for AI startups

Why it’s a fave: Many AI startups use complex pricing models that often blend a flat subscription fee per seat with usage-based charges, credits, and various add-on costs. Managing complex AI pricing on Stripe is a time-consuming, manual process. That’s why Autumn developed an open-source infrastructure that simplifies Stripe integration for AI startups. The company says its technology is already used by hundreds of AI apps and 40 YC startups. Given Stripe’s dominance in payments and the explosive growth of the AI market, could a specialized billing solution for AI be the next major fintech success story?

Massive Fundings

Arch, a seven-year-old New York startup that helps investors manage private market investments by automating data collection, capital calls, and reporting, raised a $52 million Series B round led by Oak HC/FT, with additional participation from Menlo Ventures, Craft Ventures, and Quiet Capital. More here.

Conceivable Life Sciences, a three-year-old New York startup that uses AI-powered robotics to automate IVF laboratory procedures, raised a $50 million Series A round led by Advance Venture Partners, with previous investors ARTIS Ventures, Stride, and ACME also participating. The company has raised a total of $70 million. Femtech Insider has more here.

Divergent Technologies, an 11-year-old Los Angeles company that uses advanced manufacturing to produce missile airframes and other defense parts, raised a $250 million round at a $2.3 billion valuation. Rochefort Asset Management was the deal lead. It also raised $40 million in debt. Bloomberg has more here.

HALA, a seven-year-old Saudi Arabian startup that provides digital payment and lending services to SMBs, raised a $157 million Series B round co-led by The Rise Funds and Sanabil Investments, with QED, Raed Ventures, Impact 46, Middle East Venture Partners, Isometry Capital, Arzan VC, BNVT Capital, Kaltaire Investments, Endeavor Catalyst, Nour Nouf Ventures, Khwarizmi Ventures, and Wamda Capital also piling on. Forbes has more here.

Lila Sciences, a two-year-old Boston startup that aims to use AI, robotics, and custom labs to automate experiments and accelerate discoveries in areas like medicine, chemistry, and materials, raised a $235 million Series A round at a $1.23 billion valuation. The deal was co-led by Braidwell and Collective Global, with Altitude Life Science Ventures, Alumni Ventures, ARK Venture Fund, Common Metal, Flagship Pioneering, General Catalyst, March Capital, the Mathers Foundation, Modi Ventures, NGS Super, the State of Michigan Retirement System, and a subsidiary of Abu Dhabi Investment Authority also piling on. More here.

Nothing, the five-year-old, London-based smartphone company founded by serial entrepreneur Carl Pei, has closed a $200 million Series C round led by Tiger Global at a post-money valuation of $1.3 billion. Existing backers GV, Highland Europe, EQT, Latitude, I2BF, and Tapestry also invested. The new funding takes the company’s funding to more than $450 million. TechCrunch has more here.

Remedio, a six-year-old Tel Aviv startup that uses AI to detect and fix risky misconfigurations in company networks, raised a $65 million round at a $300 million post-money valuation. The deal was led by Bessemer Venture Partners, with participation from TLV Partners and Picture Capital. Forbes has more here.

Big-But-Not-Crazy-Big Fundings

Doctronic, a one-year-old New York startup that offers AI-powered telehealth services combining personalized virtual care with access to licensed clinicians, raised a $20 million Series A round led by Lightspeed Venture Partners, with Union Square Ventures, Tusk Ventures, Mantis VC, Seven Stars, and Dr. Fei-Fei Li also participating. More here.

GreenLite Technologies, a three-year-old New York startup that uses AI with human oversight to speed commercial construction plan reviews and permitting, raised a $49.5 million Series B round led by Insight Partners, with Energize Capital, Craft Ventures, LiveOak Ventures, and Chicago Ventures also pitching in. The company has raised a total of $86 million. The Wall Street Journal has more here.

Kredete, a three-year-old New York startup that provides credit-building tools and stablecoin-powered money transfers across Africa, raised a $22 million Series A round co-led by AfricInvest Group and Financial Inclusion Vehicle, with Partech and Polymorphic Capital also investing. TechAfrica News has more here.

MarqVision, a four-year-old Los Angeles startup that uses AI to fight counterfeits and help brands recover lost revenue, raised a $48 million Series B round led by Peak XV Partners, with Salesforce Ventures, HSG, Coral Capital, and Michael Seibel as well as previous investors Y Combinator, Altos Ventures, and Atinum Investment also joining in. The company has raised a total of approximately $90 million. TechCrunch has more here.

Spara, a two-year-old New York startup that provides AI voice, email, and chat agents to help businesses instantly qualify and book sales meetings, raised a $15 million seed round co-led by Radical Ventures and Inspired Capital, with XYZ Ventures, FJ Labs, and Remarkable Ventures also anteing up. More here.

Terra Security, a one-year-old New York and Israeli startup that uses AI agents to perform continuous penetration testing under human supervision, raised a $30 million Series A round led by Felicis, with Dell Technologies Capital, and SVCI as well as previous investors SYN Ventures, Lama Partners, and Underscore VC also opting in. The company has raised a total of $38 million. CTech has more here.

Smaller Fundings

Encentive, a five-year-old German startup that uses AI to directly control industrial assets and cut electricity costs and emissions, raised a $7.4 million seed round led by General Catalyst, with HelloWorld, Summiteer, Vireo, and SIVentures also contributing. The company has raised a total of $9.8 million. Tech Funding News has more here.

Inbox Health, an eleven-year-old company based in New Haven, CT, that provides AI-enabled patient billing and payment services, raised a $20 million round led by Ten Coves Capital, with investors including CT Innovations, Commerce Ventures, Fairview Capital, I2BF, Healthy Ventures, and Vertical Venture Partners. The company has raised a total of $55 million. Mobi Health News has more here.

Meela, a four-year-old New York startup that provides an AI voice companion to help seniors combat loneliness and support emotional well-being, raised a $3.5 million seed round led by Bain Capital Ventures. CityBiz has more here.

Pascal AI, a one-year-old Bengaluru startup that uses AI to automate investment research workflows for financial firms, raised a $3.1 million seed round led by Kalaari Capital, with Norwest Venture Partners, Info Edge Ventures, and Antler also stepping up. SiliconANGLE has more here.

Sophont, a Sacramento startup founded this year that develops multimodal medical AI models trained on diverse clinical data to support applications like symptom triage, biomarker discovery, and pharmaceutical R&D, raised a $9.2 million seed round led by Kindred Ventures and including Upfront Ventures and Delphi Ventures. More here.

Sponsored By …

Big investors bet on this “unlisted” stock. When the former Zillow exec who sold his first company for $120m starts a new venture, people notice. Like the pre-IPO investors behind Uber and eBay? They already backed Pacaso. Their tech completely revamps a $1.3 trillion market, earning $110+ million in gross profit in under 5 years. They even recently reserved the Nasdaq ticker PCSO. And you can join as an investor. But not for long. Invest before the opportunity ends Thursday.

*This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving the ticker symbol is not a guarantee that the company will go public. Listing on the Nasdaq is subject to approvals.

New Funds

Robinhood just filed to launch a publicly traded “Ventures Fund I” that would let everyday investors buy into startups across sectors like AI, fintech, and defense, a bid to crack open the VC club even as details on fees, holdings, and timing remain TBD. TechCrunch has more here.

Going Public

CNBC guesses which five fintechs could be next in line to join Klarna in going public. More here.

Reuters’ Jennifer Saba pans StubHub’s IPO as just as overpriced as the concert tickets it sells. More here.

People

Elon Musk just bought $1 billion worth of Tesla stock in his first open-market purchase since 2020, a flex meant to shore up confidence in the EV maker ahead of a shareholder vote on his eye-popping new pay package. The Wall Street Journal has more here.

Deedy Das, who helped scale Glean from zero to a $7 billion valuation and co-launched Menlo Ventures’ $100 million Anthology Fund with Anthropic, has been elevated to partner. More here.

Data

OpenAI’s new user study shows 52% of its chatbot users are women, nearly half are 18 to 25, and 73% of conversations are now personal rather than work-related, with 28% seeking practical guidance, 26% focused on writing help, and 4% on coding. The Washington Post has more here.

Essential Reads

The New York Times describes how the White House advanced a deal to send the U.A.E. up to 500,000 AI chips a year at the same time as an entity controlled by the Emiratis invested $2 billion into a stablecoin minted by the Trump family and U.S. envoy Steve Witkoff, with David Sacks helping to steer the chip talks. More here.

OpenAI is rebuilding its robotics team, hiring humanoid specialists and posting jobs for teleoperation, simulation, and even mechanical engineers with mass-production experience, though it’s still unclear whether the company plans to build its own robots or partner on hardware. Wired has more here.

Religious chatbots are topping app charts, pulling in tens of millions of users and subscription dollars as people turn to AI priests, rabbis, and imams for comfort and confession. The New York Times has more here.

Rolling Stone takes a deep dive into Burning Man’s first-ever homicide, where a slashed throat, vanishing suspects, and a muted law enforcement response has shaken the festival’s utopian bubble and left burners wondering if they can ever feel safe again. More here.

Detours

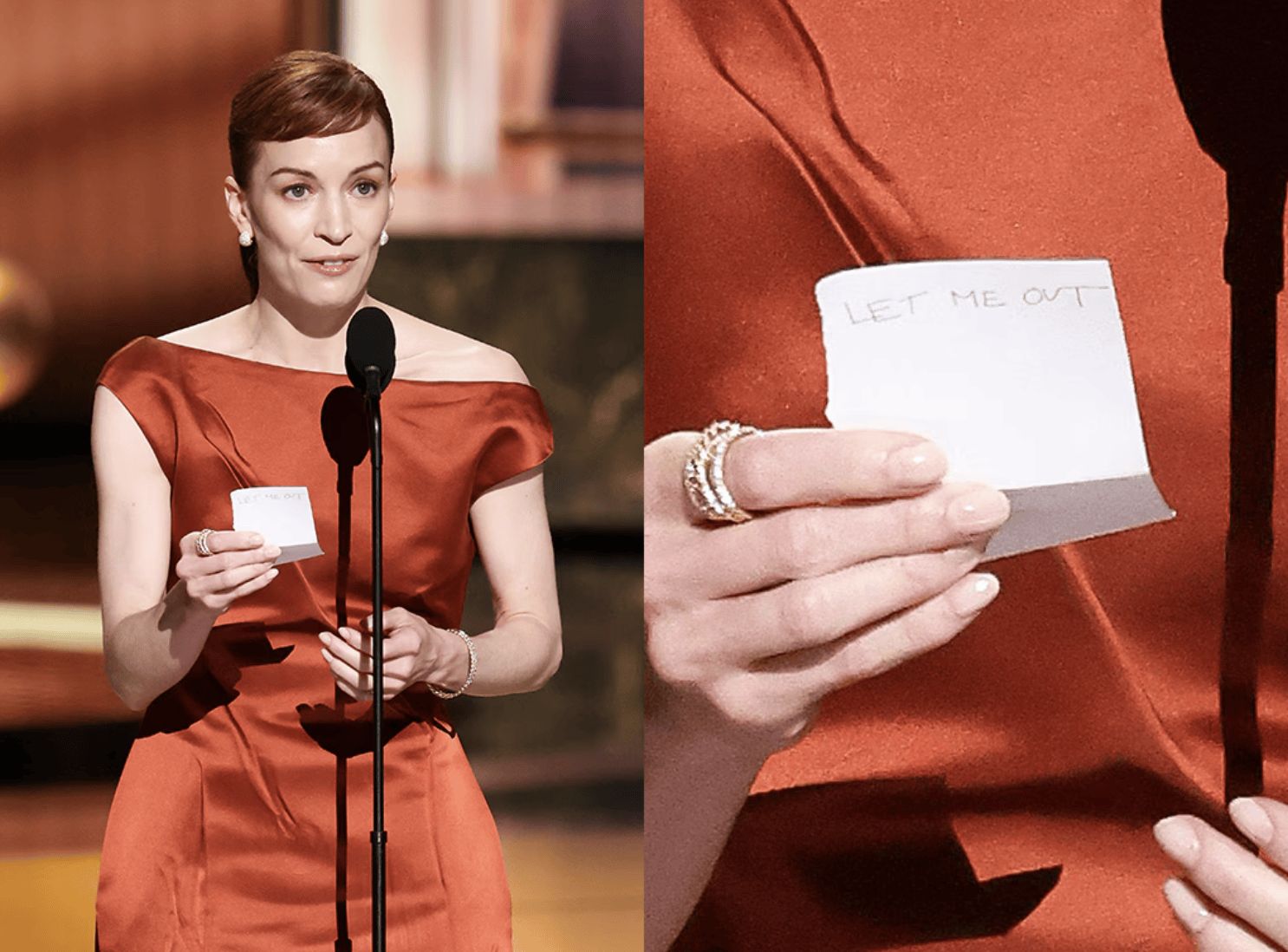

Image Credits: Sonja Flemming / CBS via Getty Images

Severance’s Britt Lower nabbed the Emmy last night for best lead actress in a drama and slipped in a brilliant Easter egg, flashing “LET ME OUT” on her speech notes in a sly nod to her character’s desperate pleas to escape her innie world.

A new Stanford study finds that Daylight Savings Time could actually be unhealthy.

Brain Rot

Retail Therapy

A Laguna Beach blufftop estate known as Chateau du Soleil just hit the market for $20 million, a rare listing given the oceanfront parcel has changed hands only three times in 125 years.

Marques Brownlee on the new AirPods Pro 3: “I get it.”

Sponsored By . . .

Ever wonder what separates the most successful founders from everyone else? Thomas Wolf (Hugging Face), Aaron Levie (Box), Kevin Rose (Digg), Jason Citron (Discord), Ryan Peterson (Flexport), Brynn Putnam (Mirror), Eric Yuan (Zoom), Chris Britt (Chime), Raquel Urtasun (Waabi) are coming (along with many others) to share what they wish they knew at day zero.

Join 10,000+ tech & VC leaders at Disrupt 2025: 250+ voices, 200 sessions, 3 days straight. October 27–29 at Moscone West, SF. Don't miss takeaways across 6 stages, breakouts, roundtables, and unmatched networking.

Save $650+ by registering now; prices rise September 26.

Tips (the non-pecuniary kind)

Please send all of your hot gossip to [email protected] or [email protected].

Want to advertise on StrictlyVC?

To book ads directly, contact us at [email protected].