Top News

A federal judge spared Google a breakup but ordered it to end exclusive search deals, share data with rivals, and open up its ad syndication, a partial win for the DOJ that reins in Google’s monopoly power without handing competitors the company’s secret sauce. TechCrunch has more here.

Anthropic just raised a staggering $13 billion at a $183 billion valuation, a significant increase over its last round just this past March in which it raised $3.5 billion at a $61.5 billion valuation. The deal was co-led by Iconiq, Fidelity, and Lightspeed Venture Partners. The company also revealed that its revenue run-rate has jumped from $1 billion in January to over $5 billion last month. TechCrunch has more here.

OpenAI is buying product-testing startup Statsig for $1.1 billion in stock, installing its founder as CTO of Applications and shifting other execs into roles focused on scientific discovery and consumer apps. TechCrunch has more here.

Table of Contents

Sponsored By …

Join us on October 1, 2025, at The Golden Gate Club, San Francisco for a day designed to cut through the noise in private capital. From AI-driven deal sourcing to smarter relationship management, Campfire brings leading investors together to turn complexity into clarity. Connect with peers, explore next-gen tools, and walk away with actionable insights to transform how your team sources, invests, and operates.

📅 October 1, 2025 📍 San Francisco, CA

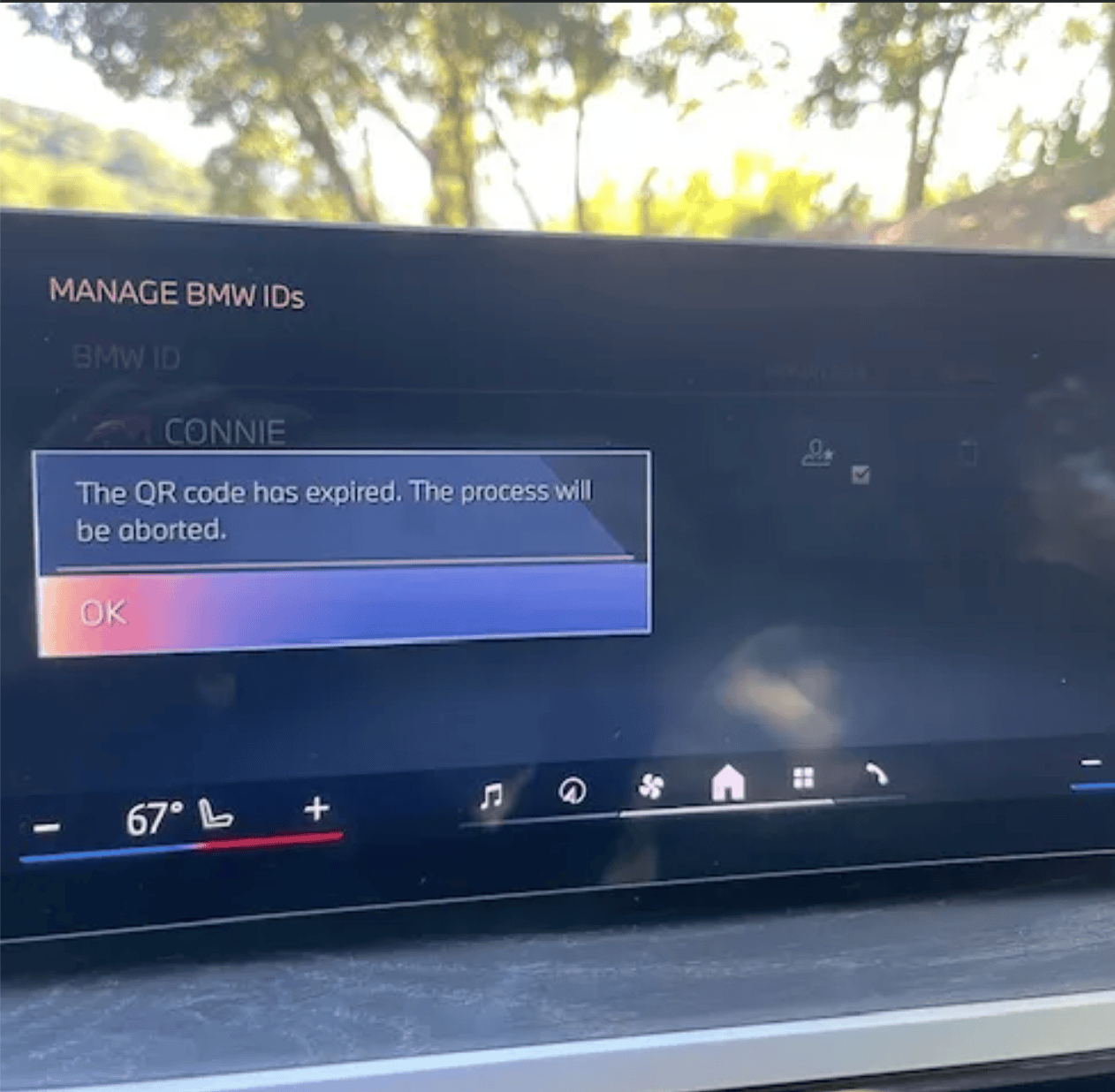

BMW, I Am So Breaking Up With You

Image Credits: Connie Loizos

By Connie Loizos

I want to be clear from the outset. I’ve never been a car enthusiast. My driving history includes a hand-me-down Volvo with a hole in the floorboards and a series of aggressively practical vehicles, including a VW Golf and a Mazda SUV in which I hauled my family around for 12 years. Then I leased a BMW i4 electric car.

What drew me to the i4? Unlike other electric vehicles, BMWs don’t look like something out of the Jetsons; I like that they’re understated cars that happen to be electric. I liked that they’re far less common than other EVs in Northern California. Plus, the i4 comes in something like a dozen colors, including “Brooklyn Gray,” which — I know I sound ridiculous — delighted me in ways that Tesla’s handful of options never could. I’d read online that early adopters were having software issues, but with visions of my sleek new BMW dancing in my head, I conveniently filed that information away. Those first few drives felt exhilarating, too. The car was beautiful, the ride was smooth, and I felt like we were going places.

Nearly two years later, I’m doing something I never thought I’d do: eagerly awaiting the end of a lease on a luxury car because its software is such a disaster that it makes my rusted-out Volvo look like a paragon of reliability.

A love story gone awry

Let me count the ways this relationship has gone wrong, starting with the most basic function: getting into my own car. On multiple occasions, I’ve stood in parking lots, unable to unlock its doors with my phone despite the BMW Digital Key being specifically designed for this purpose. This sounds trivial until you’re juggling melting groceries while looking like you’re trying to steal your own vehicle.

Digital key issues have become so widespread that BMW owners have at times shared elaborate multi-step workarounds that read like instructions for disarming a bomb: “1. Open the BMW app on your phone and use it to unlock the door. 2. Sign in with your BMW ID in iDrive. 3. Place your iPhone in the vehicle’s charging tray. 4. Wait for the digital key to reappear in the Wallet app. 5. Double-click the side button, authenticate with Face ID, and—finally—start the car.”

Massive Fundings

Fermi America, a company founded this year based in Amarillo, TX, that is developing a massive data center campus in Texas that will generate power from natural gas, solar, wind, and nuclear sources to run AI computing, raised a $100 million Series C round led by Macquarie Group. Data Center Dynamics has more here.

Kapital, a six-year-old Mexico City startup that develops software that supports its own banking operations in Mexico and Colombia, raised an $86 million round at a $1.3 billion post-money valuation. Tribe Capital and Pelion Ventures were the co-leads, with Y Combinator, Marbruck Ventures, and True Arrow also taking part. Reuters has more here.

LayerX, a four-year-old Tel Aviv startup that uses AI to help Japanese companies automate back-office work such as processing expenses, invoices, and HR paperwork, raised a $100 million Series B round led by TCV, with additional participation from MUFG Bank, Mitsubishi UFJ Innovation Partners, Jafco, Keyrock Capital, Coreline Venture, and JP Investment. The company has raised a total of $192.2 million. TechCrunch has more here.

Sierra, a two-year-old San Francisco startup that builds custom AI agents for enterprise customer service, is reportedly raising a $350 million round at a $10 billion post-money valuation, according to Axios. The deal’s purported lead is previous investor Greenoaks Capital. Axios has more here.

Big-But-Not-Crazy-Big Fundings

Citymall, a seven-year-old Indian startup that runs an online grocery service in India that sells low-cost essentials to shoppers in smaller cities and towns, raised a $47 million Series D round at a $320 million pre-money valuation, unchanged from its Series C post-money valuation. The deal was led by Accel, with previous investors Waterbridge Ventures, Citius, General Catalyst, Elevation Capital, Norwest Venture Partners, and Jungle Ventures also piling on. The company has raised a total of $165 million. TechCrunch has more here.

Flex, a four-year-old Miami startup that helps retailers accept health savings and flexible spending accounts directly at checkout so consumers can use their pre-tax health dollars more easily, raised a $15 million Series A round co-led by First Round and Core VC, with Rethink Impact and Cameron Ventures also stepping up. More here.

Lizy, a seven-year-old Belgian startup that leases used electric cars through a fully digital platform to businesses across Europe, raised an $11.6 million round. Previous investors D'Ieteren, Alychlo, and NewAlpha Asset Management co-led the deal. The company also raised $75.6 million in debt. Tech Funding News has more here.

Offgrid Energy Labs, a seven-year-old Indian startup that develops zinc-bromine batteries as a lower-cost, longer-lasting alternative to lithium for energy storage in sectors like renewables and off-grid power, raised a $15 million Series A round led by Archean Chemicals, with Ankur Capital also pitching in. TechCrunch has more here.

Phasecraft, an eight-year-old UK startup that develops hardware-agnostic quantum algorithms for applications in materials science, energy, telecom, and life sciences, raised a $34 million Series B round co-led by Plural, Novo Nordisk, and previous investor Playground Global, with prior backers LocalGlobe, AlbionVC, and Parkwalk Advisors also investing. The company has raised a total of $50+ million. More here.

Predoc, a four-year-old New York startup that uses AI to gather and organize patient medical records from multiple sources so healthcare providers can more easily access clinical information, raised a $30 million seed and Series A round led by Base10 Partners and including Northzone, ERA Ventures, and ENIAC Ventures. Mobi Health News has more here.

Smaller Fundings

Loman AI, a two-year-old Austin startup that provides an AI phone agent for restaurants to handle orders, reservations, and customer questions, raised a $3.5 million seed round led by Next Coast Ventures, with TenOneTen Ventures and Antler also engaging. More here.

Sponsored By …

Join 10,000 tech & VC leaders at Disrupt 2025, because missing this event means you'll spend the next year awkwardly pretending you know what everyone's talking about at every coffee meeting. Register now to save more than $650 on your ticket.

Exits

Varonis, a twenty-year-old New York company that helps organizations secure sensitive data, is buying AI-driven email security startup SlashNext for up to $150 million. Bloomberg has more here.

Going Public

It’s official: Klarna, the 19-year-old Stockholm BNPL pioneer, is reviving its IPO plans with a goal of raising $1.27 billion at a valuation of up to $14 billion, a big reset from the $45 billion valuation that it previously targeted. TechCrunch has more here.

Gemini, an eleven-year-old New York cryptocurrency exchange co-founded by the Winklevoss twins, is seeking a $2.22 billion valuation in its U.S. IPO while aiming to raise up to $317 million. CoinDesk has more here.

Figure Technologies, a seven-year-old San Francisco startup that runs a blockchain-based lending and trading platform, is targeting a Nasdaq IPO at up to a $4.1 billion valuation. Reuters has more here.

People

Lovable CEO and co-founder Anton Osika talked to TechCrunch about how his eight-month-old Stockholm unicorn, now pulling in $100 million ARR and valued at $1.8 billion, is betting that vibe coding can evolve from flashy demos into full product development, staking a claim as Europe’s breakout AI darling while brushing off competition from the model providers themselves. TechCrunch has more here.

Salesforce CEO Marc Benioff said the company has cut 4,000 customer support jobs this year as AI agents now handle half of all service interactions. The San Francisco Chronicle has more here.

According to reporting from Business Insider, YouTube influencer MrBeast is planning on launching a mobile phone network next year. TechCrunch has more here.

Post-Its

Essential Reads

Bloomberg profiles Speedrun, an Andreesen Horowitz accelerator that has been quietly taking on Y Combinator by ploughing $180 million into 150 companies over the last 18 months. More here.

Tesla’s fourth “Master Plan” is a vague ode to robots and sustainable energy that skips the specifics, highlighting the growing gap between Musk’s lofty rhetoric and the many unfulfilled promises from Tesla’s earlier master plans. TechCrunch has more here.

Under pressure after a California family sued over their son’s suicide, OpenAI says it will add parental controls that notify guardians when teens show signs of acute distress, route high-risk conversations to a slower, safety-trained model designed to de-escalate, and make it easier to connect users to emergency services. TechCrunch has more here.

Speaking of OpenAI, the company is subpoenaing nonprofit AI governance groups and suggesting they’re secretly funded by Elon Musk, Mark Zuckerberg, and Anthropic’s billionaire backers, a move that frames opposition to its for-profit pivot as part of a billionaire conspiracy. The San Francisco Standard has more here.

Detours

The New York Times uses satellite photography to reveal how pickleball has added more than 26,000 new courts since 2018, often at the expense of tennis real estate.

Boosted by influencers and unlikely advocates like Twitter co-founder Jack Dorsey, young people are increasingly "tanmaxxing," or ditching sunscreen and timing tans to achieve peak UV.

Brain Rot

A view from above …

Retail Therapy

La Fin, a $139 million Bel-Air megamansion, comes loaded with billionaire bait, including a sub-zero vodka tasting room, cigar lounge, six-car auto elevator, rooftop spa, and more than enough fire pits and marble to make even LA’s trophy-home crowd blink.

A Porsche-powered dune buggy.

Tips (the non-pecuniary kind)

Please send all of your hot gossip to [email protected] or [email protected].

Want to advertise on StrictlyVC?

To book ads directly, contact us at [email protected].