Top News

Meta scored a major win as a federal judge threw out the FTC’s attempt to unwind its Instagram and WhatsApp deals, a ruling that highlights how fast-moving competition from TikTok and other rivals has changed the social media landscape. The Wall Street Journal has more here.

A major outage at Cloudflare knocked major services like ChatGPT, Claude, and Spotify offline and took down X just a month after Elon Musk mocked AWS customers for losing connectivity. TechCrunch has more here.

Anthropic’s valuation surged into the $350 billion range as Microsoft and Nvidia committed up to $15 billion in new investments. CNBC has more here.

Speaking of valuations, The Information is reporting that Databricks, a 13-year-old San Francisco company that enables companies to store, process, and analyze large amounts of data using collaborative tools built around Apache Spark, is in the market to raise a round at a $130+ billion valuation, a 30% increase over the price of its last round just two months ago. TechCrunch has more here.

And still more on valuations: Elon Musk’s xAI is reportedly negotiating a $15 billion equity raise that would lift its valuation to about $230 billion. The Wall Street Journal has more here.

Sponsored By …

As funds scale, portfolio reporting becomes the bottleneck.

PortfolioIQ automates data collection and standardization across your portfolio - extracting metrics from any format, cleaning inconsistencies, and structuring everything for in-depth analysis. Handle 5x more portfolio companies with the same team.

‘Our Funds Are 20 Years Old’: Limited Partners Confront VCs’ Liquidity Crisis

Image Credits: jmbatt / Getty Images

By Connie Loizos

These days, it’s not easy to be a limited partner who invests in venture capital firms. The “LPs” who fund VCs are confronting an asset class in flux: Funds have nearly twice the lifespan they used to, emerging managers face life-or-death fundraising challenges, and billions of dollars sit trapped in startups that may never justify their 2021 valuations.

Indeed, at a recent StrictlyVC panel in San Francisco, above the din of the boisterous crowd gathered to watch it, five prominent LPs, representing endowments, fund-of-funds, and secondaries firms managing over $100 billion combined, painted a surprising picture of venture capital’s current state, even as they see areas of opportunity emerging from the upheaval.

Perhaps the most striking revelation was that venture funds are living far longer than anyone planned for, creating a raft of problems for institutional investors.

“Conventional wisdom may have suggested 13-year-old funds,” said Adam Grosher, a director at the J. Paul Getty Trust, which manages $9.5 billion. “In our own portfolio, we have funds that are 15, 18, even 20 years old that still hold marquee assets, blue-chip assets that we would be happy to hold.” Still, the “asset class is just a lot more illiquid” than most might imagine based on the history of the industry, he said.

This extended timeline is forcing LPs to rip up and rebuild their allocation models. Lara Banks of Makena Capital, which manages $6 billion in private equity and venture capital, noted her firm now models an 18-year fund life, with the majority of capital actually returning in years 16 through 18. Meanwhile, the J. Paul Getty Trust is actively revisiting how much capital to deploy, leaning toward more conservative allocations to avoid overexposure.

Massive Fundings

Faire, a nine-year-old San Francisco startup that connects brands with retailers, has reportedly initiated a $100 million tender offer that lets employees sell shares at a $5.2 billion valuation. The deal is being led by WCM Investment Management, with additional participation from Baillie Gifford and True North Fund. Bloomberg has more here.

Lambda, a 13-year-old company based in San Jose, CA, that rents access to advanced GPUs for AI workloads, raised a $1.5+ billion Series E round led by TWG Global, with US Innovative Technology Fund also weighing in. The company has raised a total of $2.3 billion. The Wall Street Journal has more here.

SmartHR, a 12-year-old Tokyo company that provides a cloud-based HR management system for Japanese businesses, raised a $96 million minority investment by General Atlantic. More here.

Venn, a nine-year-old New York startup that helps multifamily property operators manage resident relationships and unlock new revenue streams, raised a $52 million Series B round co-led by NOA and CIM Group, with Group 11, Oren Zeev, Hamilton Lane, Latitude, LocalGlobe, and FinTLV also participating. The company has raised a total of $140 million. CTech has more here.

Big-But-Not-Crazy-Big Fundings

Agentio, a two-year-old New York startup that connects brands with creators for automated ad campaigns, raised a $40 million Series B round at a $340 million post-money valuation. The deal was led by Forerunner, with Benchmark, Craft Ventures, AlleyCorp, Antler, and Starting Line also participating. The company has raised a total of $56 million. TechCrunch has more here.

Albatross, a one-year-old Zurich startup that helps that helps users find relevant products and content in real-time, raised an $12.5million round led by MMC Ventures, with Redalpine and Daphni also investing. Tech.eu has more here.

Apono, a three-year-old Tel Aviv startup that provides dynamic, real-time access controls to eliminate standing cloud privileges, raised a $34 million Series B round led by U.S. Venture Partners, with Swisscom Ventures, Vertex Ventures, and 33N Ventures also participating. The company has raised a total of $54 million. SiliconANGLE has more here.

Bone AI, two-year-old Seoul and Palo Alto startup that is developing autonomous air, ground, and marine vehicles, raised a $12 million seed round led by Third Prime, with Kolon Group also pitching in. TechCrunch has more here.

Chargeflow, a four-year-old Israeli startup that automates chargeback and post-transaction fraud workflows for online merchants, raised a $25 million Series A round and $10 million in debt. The equity piece was led by Viola Growth, with previous investor OpenView Venture Partners also taking part. The company has raised a total of $49 million. CTech has more here.

Hummink, a six-year-old Paris startup that helps manufacturers print and repair microelectronic circuitry at sub-micron scale, raised a $16.2 million round co-led by KBC Focus Fund, Cap Horn, and Bpifrance, with previous investors Elaia Partners, Sensinnovat, and Beeyond also pitching in. More here.

Jiga, a six-year-old San Francisco startup that automates hardware sourcing for engineers, raised a $12 million Series A round. The round was led by Aleph, with Symbol and Y Combinator also opting in. More here.

Maxima, a one-year-old startup based in San Mateo, CA, that automates the month-end accounting close with AI agents that co-prepare financial reports alongside accounting teams, raised a total of $41 million in seed and Series A funds. Investors included Redpoint Ventures, Kleiner Perkins, and Audacious Ventures. More here.

Peec AI, a two-year-old Berlin startup that helps brands monitor and improve how they appear in AI-powered searches, raised a $21 million Series A round led by Singular, with Antler, Combination VC, identity.vc, and S20 also contributing. TechCrunch has more here.

PicoJool, a one-year-old Palo Alto startup that is working on optical connectivity technology, raised a $12 million seed round. Playground Global was the deal lead. Tech Funding News has more here.

Sphere, a two-year-old New York startup that automates global tax registration, calculation, filing, and remittance, raised a $21 million Series A round led by Andreessen Horowitz, with Y Combinator and Felicis Ventures also taking stakes. TechCrunch has more here.

Smaller Fundings

AlertD, a one-year-old startup based in Walnut Creek, CA, that provides AI-driven tools to help engineering teams monitor and manage cloud systems, raised a $3 million pre-seed round led by True Ventures. More here.

Backflip, a five-year-old Denver startup that provides technology and capital products to residential real estate investors, raised a $10 million round. Investors included prior backers FirstMark Capital, LiveOak Venture Partners, and Vertical Venture Partners. More here.

Cellbyte, a one-year-old Munich startup that provides AI-powered software to help pharmaceutical companies manage drug launches, raised a $2.75 million seed round led by Frontline Ventures, with Y Combinator, Pace Ventures, Saras Capital, and Springboard Health Angels also engaging. Tech Funding News has more here.

Condukt, a four-year-old London startup that provides a real-time data layer to automate business-verification compliance workflows, raised a $10 million seed round co-led by Lightspeed Venture Partners and MMC Ventures, with Cocoa Ventures also stepping up. UKTN has more here.

Hammerhead AI, a one-year-old startup based in Redwood City, CA, that uses AI agents to optimize GPU energy use in data centers, raised a $10 million seed round led by Buoyant Ventures, with SE Ventures, AINA Climate AI Ventures, MCJ Collective, Wovenearth Ventures, Bombellii Ventures, Clearvision Ventures, Stepchange, and Acclimate Ventures also chiming in. SiliconANGLE has more here.

Keychain, a two-year-old New York startup that provides an AI-powered manufacturing system for private label consumer goods, raised a $9.9 million round. Investors included W23 Global, Tesco, Ahold Delhaize, Woolworths Group, Empire Company Limited, and Shoprite Group. Silicon Republic has more here.

Pionix, a five-year-old German startup that is building an open-source EV charging system, raised a $9.3 million round led by Ascend Capital Partners and including Start-up BW Seed Fonds, Pale blue dot, Vireo Ventures, and Axeleo Ventures. Tech Funding News has more here.

SubImage, a two-year-old San Francisco startup that maps cloud assets through an open-core security graph, raised a $4.2 million seed round. Investors included FundersClub, Y Combinator, Phosphor Capital, and Transpose Platform. More here.

Sponsored By …

Private capital enters 2026 at a turning point. According to Affinity’s 2026 Predictions Survey, 54% of investors say proving the value of existing funds is their top challenge, while 67% expect more deal activity despite exit uncertainty. Join leaders from Northwestern Mutual and Armira for Affinity’s 2026 Private Capital Predictions webinar to uncover how firms are adapting strategies, strengthening LP relationships, and using AI to drive performance in a volatile market.

New Funds

nvp capital, an eight-year-old New York VC firm that backs seed-stage enterprise software and vertical AI startups, raised its second fund in the amount of $80 million. Pulse 2.0 has more here.

Exits

SAFE, a Palo Alto cyber risk company, is acquiring Balbix, a nine-year-old San Jose company that provides an AI-native continuous threat exposure management system. Terms were not disclosed. More here.

People

Soumith Chintala, a top Meta AI researcher, has jumped to Mira Murati’s Thinking Machines Lab in a major win for the young AI startup. Business Insider has more here.

And speaking of Meta departures, Meta’s long-time revenue chief John Hegeman is exiting after nearly two decades to start his own company. The Wall Street Journal has more here.

Although recently released emails from Jeffrey Epstein have led former Harvard president and economist Larry Summers to step back from public commitments, he is still listed as a member of OpenAI’s board, and the company has declined to comment on his status. NBC News has more here.

It seems like even Sundar Pichai thinks the AI investment boom has “elements of irrationality.” The BBC has more here.

Post-Its

Data

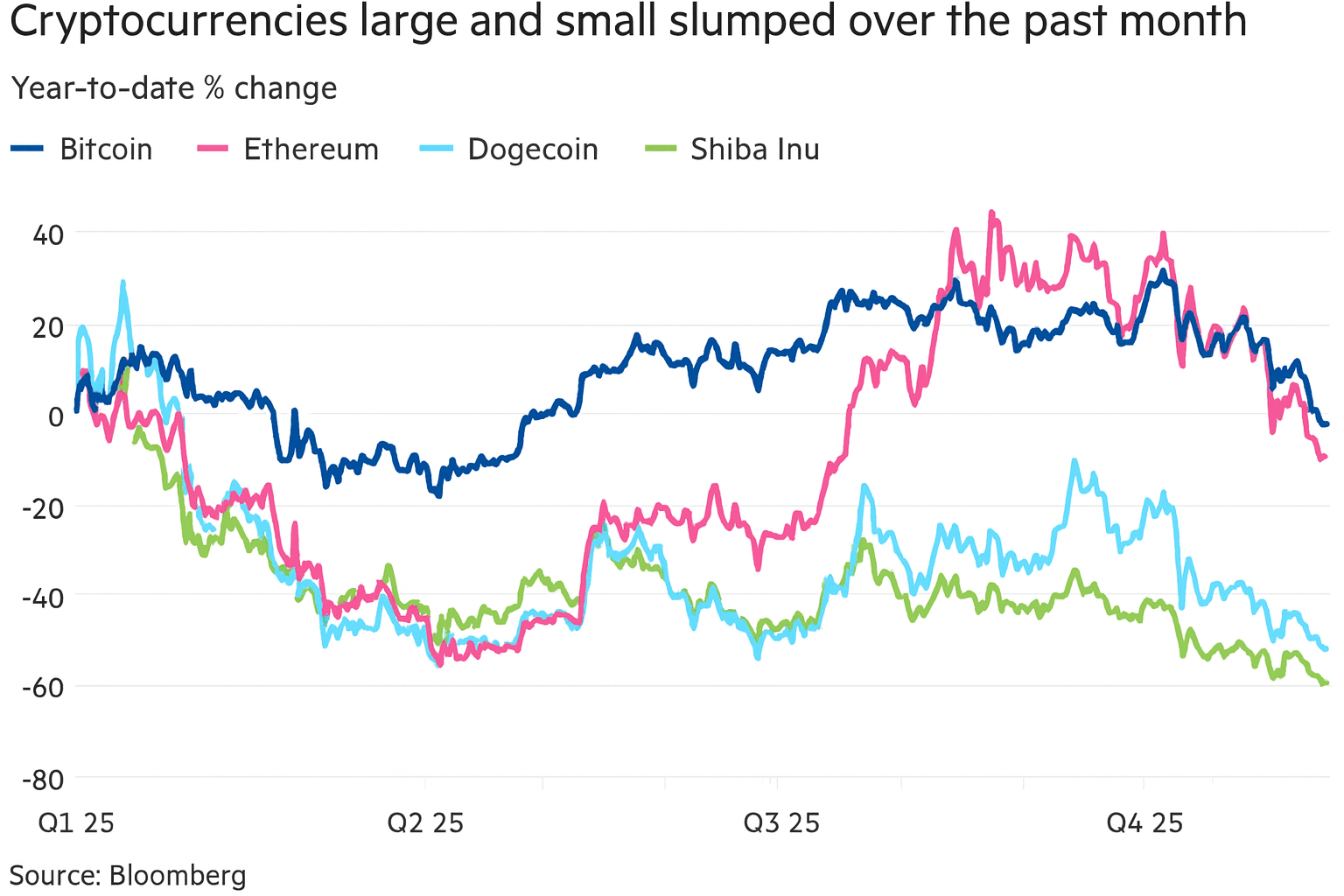

Crypto’s sharp six-week downturn has erased roughly $1.2 trillion in value as bitcoin fell about 28 percent and several major alt coins dropped more than 40 percent, reflecting rising rate worries, stretched tech valuations, and the lingering effects of October’s large leveraged unwind. The Financial Times has more here.

Essential Reads

Researchers showed that a trivial WhatsApp contact-discovery trick could enable hackers to scrape up to 3.5 billion phone numbers. WIRED has more here.

Meta’s sweeping antitrust win today (see Top News above) could mean that Big Tech is once again be free to buy start-ups outright rather than rely on convoluted acquihires to secure coveted AI talent. The New York Times has more here.

Detours

If you love Tom Hanks, don’t see this show.

If my Bluetooth could talk.

Brain Rot

A proper British advert. [H/T Jason Kottke.]

Retail Therapy

Triumph’s limited edition Street Triple 765 Moto2 Edition is almost certainly more motorcycle than you can handle.

Desk speakers that will keep you rooted at work.

Tips (the non-pecuniary kind)

Please send all of your hot gossip to [email protected] or [email protected].

Want to advertise on StrictlyVC?

To book ads directly, contact us at [email protected].