Weekend! Also, thanks to those of you who took our survey last night (we’re trying to serve you better by figuring out a bit more about who’s reading this thing). If you have five minutes this weekend to fly through it, we’d love your thoughts. - CL

Top News

The Department of Justice has widened its antitrust review of Netflix’s proposed multibillion-dollar acquisition of Warner Bros. Discovery, issuing subpoenas that probe whether the streamer’s business practices and past conduct could entrench market power or amount to exclusionary tactics. The Wall Street Journal has more here.

EU regulators issued a preliminary ruling accusing TikTok’s infinite scroll, autoplay, and recommendation system of illegal “addictive design,” potentially forcing product changes for its 200 million European users and exposing ByteDance to fines of up to 6% of global revenue. The New York Times has more here.

Amazon disclosed today that its $8 billion investment in Anthropic has ballooned to about $60.6 billion on paper, driven by convertible notes and preferred stock tied to the startup’s funding rounds. Business Insider has more here.

Sponsored By …

“Scout, identify strong follow-on investors for one of my recent deals @Company”

Agents built for investing.

Benchmark Raises $225M in Special Funds to Double Down on Cerebras

Image Credits: Pavlo Gonchar / SOPA Images / LightRocket / Getty Images

By Marina Temkin

This week, AI chipmaker Cerebras Systems announced that it raised $1 billion in fresh capital at a valuation of $23 billion — a nearly threefold increase from the $8.1 billion valuation the Nvidia rival had reached just six months earlier.

While the round was led by Tiger Global, a huge part of the new capital came from one of the company’s earliest backers: Benchmark Capital. The prominent Silicon Valley firm invested at least $225 million in Cerebras’ latest round, according to a person familiar with the deal.

Benchmark first bet on 10-year-old Cerebras when it led the startup’s $27 million Series A in 2016. Since Benchmark deliberately keeps its funds under $450 million, the firm raised two separate vehicles, both called ‘Benchmark Infrastructure,’ according to regulatory filings. According to the person familiar with the deal, these vehicles were created specifically to fund the Cerebras investment.

Benchmark declined to comment.

What sets Cerebras apart is the sheer physical scale of its processors. The company’s Wafer Scale Engine, its flagship chip announced in 2024, measures approximately 8.5 inches on each side and packs 4 trillion transistors into a single piece of silicon. To put that in perspective, the chip is manufactured from nearly an entire 300-millimeter silicon wafer, the circular discs that serve as the foundation for all semiconductor production. Traditional chips are thumbnail-sized fragments cut from these wafers; Cerebras instead uses almost the whole circle.

Big-But-Not-Crazy-Big Fundings

Bound, a five-year-old London startup that automates FX hedging for businesses, raised a $24.5 million Series A round led by AlbionVC, with Notion Capital and GoHub Ventures also participating. EU-Startups has more here.

Daytona, a three-year-old New York startup that lets software agents run and manage long-running computing tasks at scale, raised a $24 million Series A round led by FirstMark Capital, with Pace Capital, Upfront Ventures, Darkmode, E2VC, Datadog, and Figma Ventures also contributing. More here.

Vexlum, a nine-year-old Finnish startup that manufactures high-power semiconductor lasers for quantum, space, and optical markets, raised an $11.8 million seed round led by Kvanted, with additional support from Tesi and the EIC Fund. More here.

Smaller Fundings

Feltsense Holdings, a one-year-old Los Angeles startup that runs autonomous software agents to create and scale new companies, raised a $5.1 million seed round led by Draper Associates, with Precursor Ventures and Liquid2 Ventures also investing. More here.

Fintower, a two-year-old startup based in Gothenburg, Sweden, that centralizes budgeting, forecasting, and scenario analysis in a single financial planning system, raised a $1.8 million seed round at a $6.6 million valuation. Investors included Chalmers Ventures and Akka. Tech Funding News has more here.

Geolinks Services, a six-year-old Paris startup that provides subsurface modeling for mining, carbon capture and storage, and natural hydrogen projects, raised a $7.1 million round. Investors included Calderion, the French Tech Seed Fund, BRGM Invest, and InnoEnergy. chemXplore has more here.

Phathom Technologies, a two-year-old startup based in Halifax, Nova Scotia, that removes carbon emissions from bioenergy plants and stores them permanently, raised a $4 million seed round led by Propeller Ventures, with the New Brunswick Innovation Foundation, Invest Nova Scotia, and Carmeuse Ventures also participating. The company has raised a total of $12+ million. More here.

Pluto Markets, a five-year-old Copenhagen startup that offers commission-free trading for fractional stocks, ETFs, and cryptocurrencies, raised a $6 million seed round. Seed Capital was the deal lead. Tech.eu has more here.

Spire, a 17-year-old Dallas startup that enables bank-account payments to run through existing credit card networks, raised a $10 million Series B round. Continental Investment Partners led the transaction. More here.

Uplift360, a five-year-old startup based in Bristol, UK, that regenerates high-value composite materials for reuse across aerospace, defence, and industrial supply chains, raised an $8.7 million seed round led by Extantia, with the NATO Innovation Fund, Promus Ventures, and Fund F also taking part. EU-Startups has more here.

Valeria, a two-year-old Barcelona startup that automates payroll, onboarding, and compliance for high-turnover frontline workforces, raised a $2 million seed round led by Venture Friends, with Fortino Capital and 10k Ventures also engaging. More here.

Willo, a two-year-old Finnish startup that delivers wireless power to devices while they are in motion and not docked to chargers, raised a $3.4 million pre-seed round. byFounders was the deal lead, with Interface Capital, Unruly Capital, and Wave Ventures also stepping up. Tech.eu has more here.

Sponsored By …

Exhausted from end-of-year reporting? Your finance team and portfolio companies are too. That’s why 140+ VCs trust Standard Metrics’ new AI Analyst to pull data, uncover follow-on opportunities, summarize performance trends, and so much more. First data collection was automated. Now portfolio analysis is too. Don’t let the fire drills repeat every quarter. Learn more.

New Funds

MASNA Ventures, a firm founded by an American entrepreneur, is raising at least $100 million for Saudi Arabia’s first defense-focused venture fund to back US and allied defense startups and help scale manufacturing in the kingdom. The fund plans about 10 investments across drones, precision munitions, and AI-enabled systems as US-Saudi defense cooperation deepens. Semafor has more here.

Exits

Head’s up, readers! Reddit says it is hunting for adtech acquisitions, arguing that buying proven tools will allow it to add monetization capabilities faster than building these tools in-house. (Ads generated $690 million of the company’s $726 million in quarterly revenue.) TechCrunch has more here.

Going Public

Once Upon a Farm, an 11-year-old Berkeley company co-founded by actress Jennifer Garner that makes refrigerated pouches, snacks, and meals without added sugar or preservatives, jumped 17% in its NYSE debut. The company has raised $115+ million from investors like S2G Investments, CAVU Consumer Partners, Cambridge Companies, Beechwood Capital, and Haus Capital. The Wall Street Journal has more here.

People

Crypto.com CEO Kris Marszalek is launching ai.com, a new consumer platform for personal, autonomous AI agents that execute tasks on users’ behalf, and he’s not holding back. In addition to paying $70 million for the domain, he’s introducing the company with a Super Bowl LX commercial this Sunday. PYMNTS has more here.

Meta CEO Mark Zuckerberg privately questioned whether the company should scale back how it researches its societal impact after internal Instagram studies showing 32% of teen girls felt worse about their bodies became public. The Verge has more here.

According to The Wall Street Journal, Elon Musk approved the SpaceX and xAI merger after SpaceX engineers made a “technical breakthrough” last fall on in-orbit power, cooling, and laser-based data links that made orbital data centers for AI workloads plausible. More here.

Derik Kaufmann, founder of AI startup RunRL, says he is organizing a “March for Billionaires” in San Francisco to protest California’s proposed one-time 5% wealth tax on residents worth more than $1 billion even though he acknowledges that the rally will only draw a few dozen people. TechCrunch has more here.

Post-Its

Data

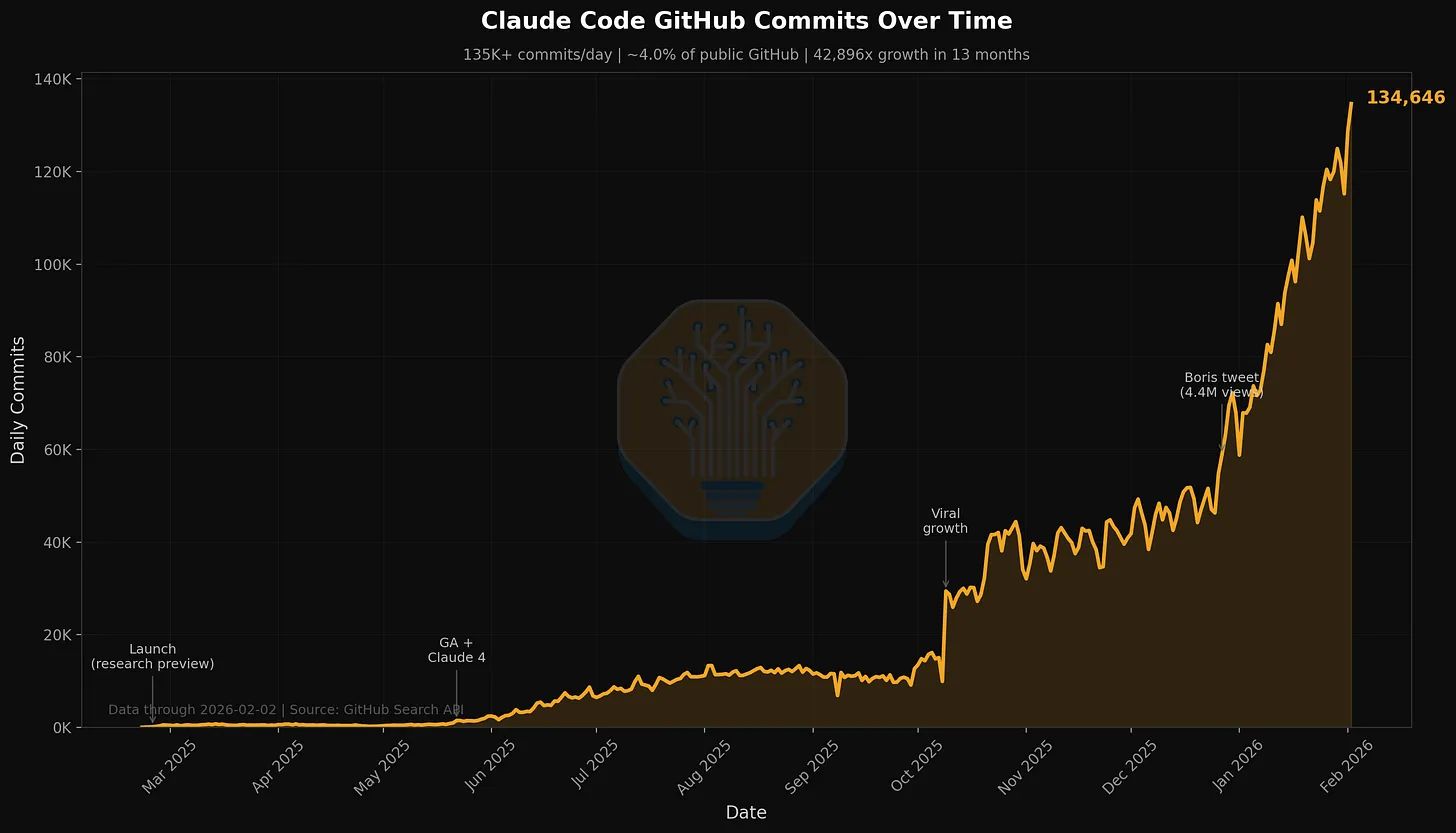

Image Credits: Source: Tokenomics Team, Github, Generated by Claude Code

The research publication SemiAnalysis reports that Anthropic’s Claude Code is already authoring about 4% of public GitHub commits and is tracking toward more than 20% by the end of 2026. More here.

Essential Reads

Alphabet, Amazon, Meta, and Microsoft project about $650 billion in combined 2026 capex for data centers and AI infrastructure, roughly 60% higher than the previous year, rattling stocks and straining power, labor, and credit markets. Bloomberg puts it into perspective here.

Goldman Sachs has spent six months working with Anthropic engineers to build autonomous AI agents for accounting, trade reconciliation, and client onboarding, betting the technology can compress time-intensive, rules-based work while constraining future headcount growth rather than cutting jobs. CNBC has more here.

Waymo said it is training its autonomous vehicles with Google-built simulations that turn text prompts and real dashcam data into synthetic driving worlds – including camera and lidar views – to test rare edge cases and accelerate robotaxi rollouts to about a dozen cities. Bloomberg has more here.

Rotten Tomatoes’ parent Versant denied claims that the documentary Melania was boosted by bots after it posted a record 99% audience score versus a 6% critic rating, a gap that watchdogs and box-office analysts said showed signs of coordinated or inauthentic behavior. The Daily Beast has more here.

Detours

These countries just won the fashion Olympics.

Families are increasingly wondering whether to stage AI interventions for loved ones who can’t seem to make a decision without consulting their chatbot.

Brain Rot

Retail Therapy

This 26,260 square foot San Francisco manse boasts nine bedrooms, ten full bathrooms, and five half bathrooms and includes a full indoor basketball court, a golf simulator, a wine room, a wellness floor, a six-car garage, and a rooftop terrace with a hot tub and Golden Gate Bridge views. For those of you in the market for a compound.

Tips (the non-pecuniary kind)

Please send all of your hot gossip to [email protected] or [email protected].

Want to advertise on StrictlyVC?

To book ads directly, contact us at [email protected].