Top News

President Trump pardoned Binance founder Changpeng “CZ” Zhao, clearing the way for the crypto exchange’s U.S. return and deepening ties between Trump’s family-backed crypto venture and one of the industry’s most powerful players. The Wall Street Journal has more here.

The Trump administration is in talks to take equity stakes of at least $10 million each in quantum-computing companies including IonQ, Rigetti, and D-Wave, signaling a deeper federal push into next-generation tech ownership. The Wall Street Journal has more here.

Confirming earlier reports, Anthropic announced that it has struck a cloud deal with Google worth tens of billions of dollars that gives it access to up to one million of Google’s custom TPUs. CNBC has more here.

Sponsored By …

Leading private capital firms rely on Affinity to identify the right opportunities, make critical connections, and drive better outcomes—from sourcing and diligence to portfolio management and fundraising. Affinity AI lets deal teams instantly add, sort, and surface critical people and deal notes, ask questions about their network, and integrate data into existing tools. Affinity is the Relationship Intelligence Platform purpose-built for the unique workflows and deal processes in private capital. See how top firms use Affinity AI.

20-Year-Old Dropouts Built AI Notetaker Turbo AI to 5 Million Users

By Tage Kene-Okafor

Five million users. Eight-figure annual recurring revenue. Twenty thousand new users joining daily. These are some solid numbers for a startup called Turbo AI launched in early 2024 by Rudy Arora and Sarthak Dhawan, two 20-year-old college dropouts.

Most of this growth has come in the past six months, the founders tell TechCrunch, during which their AI-powered note-taking and study tool grew from one million to five million users, while remaining profitable.

They say the idea for Turbo stemmed from a classroom problem many college students face, which is trying to take notes while paying attention to a lecture at the same time.

“I would always struggle with taking notes because I just couldn’t both listen to the teacher and write at the same time. I just couldn’t do it,” said CEO Dhawan. “Every time I tried to take notes, I’d stop paying attention. And when I listened, I couldn’t take notes. I was like, what if I could use AI?”

So the pair built Turbolearn as a side project to allow them to record lectures and automatically generate notes, flashcards, and quizzes. They began sharing it with friends, then it spread to classmates across Duke and Northwestern, where they were enrolled until dropping out this year. Within months, the app had reached other universities, including Harvard and MIT.

The product takes the usual note-taker formula—record, transcribe, summarize—and makes it interactive with study notes, quizzes, and flashcards, along with a built-in chat assistant that explains key terms or concepts.

Massive Fundings

Crusoe, a seven-year-old Denver startup that builds data centers and energy infrastructure to power AI workloads, raised a $1.4 billion equity round at a $10+ billion valuation. The round was co-led by Mubadala Capital and Valor Equity Partners. The company has raised a total of $3.9 billion. The Financial Times has more here.

Electra Therapeutics, a seven-year-old San Francisco startup that develops treatments for rare inflammatory and blood diseases, raised a $183 million Series C round co-led by Nextech and EQT Life Sciences, with Sanofi, HBM Healthcare Investments, and Mubadala Capital also pitching in. BioPharma Dive has more here.

Redwood Materials, an eight-year-old startup based in Carson City, NV, that recycles and repurposes EV batteries for energy storage, raised a $350 million Series E round at a reported $6 billion valuation. The round was led by Eclipse, with NVentures also participating. TechCrunch has more here.

ROLLER, a fifteen-year-old Austin company that provides venue management software for leisure and attractions operators, raised a $50 million round led by Insight Partners, with J.P. Morgan also participating. More here.

Big-But-Not-Crazy-Big Fundings

Acoru, a two-year-old Madrid startup that helps banks detect and prevent AI-driven fraud and money laundering, raised an $11.6 million Series A round led by 33N Ventures, with additional participation from Adara Ventures and Athos Capital. EU-Startups has more here.

Brico, a two-year-old San Francisco startup that automates state and federal licensing for financial institutions, raised a $13.5 million Series A round led by previous investor Flourish Ventures, with Restive Ventures and Pear VC also contributing. More here.

Clerq, a three-year-old New York company that enables account-to-account payments for high-ticket transactions, raised a $12 million Series A round led by 645 Ventures, with additional support from previous investors FirstMark Capital, Fika Ventures, Commerce Ventures, and Dash Fund. CityBiz has more here.

CurbWaste, a seven-year-old New York startup that helps waste haulers digitize operations and use AI for route, payment, and inventory management, raised a $28 million Series B round led by Socium Ventures, with Flourish Ventures, TTV Capital, B Capital Group, and SquarePoint Capital also contributing. The startup has raised a total of $50 million. Waste Dive has more here.

Generation Lab, a San Francisco startup that develops longevity diagnostics based on biological age analysis, raised an $11 million seed round. The round was led by Accel, with Samsung Next, Zone2, Aoki Labs, Build Your Legacy Ventures, and Markham Valley Ventures also participating. The startup has raised a total of $15 million. More here.

Gimlet Labs, a San Francisco startup that is working on technology to make agentic AI workloads more efficient across heterogeneous hardware, raised a $12 million seed round led by Factory. More here.

GradBridge, a Philadelphia startup founded this year that provides second-look private student loans to help students complete their degrees, raised a $20 million Series A round led by Acorn Investment Partners. More here.

Pave Bank, a three-year-old Singapore-based company licensed by the National Bank of Georgia that offers a programmable commercial bank for both fiat and digital assets, raised a $39 million Series A round led by Accel and including Tether Investments, Wintermute, Quona Capital, and Helios Digital Ventures. The Block has more here.

Riff, a four-year-old Oslo startup that enables non-technical teams to build data-heavy applications without code, raised a $16 million Series A round led by Northzone, with Skyfall Ventures, Maki.vc, Sondo Capital, Global Founders Capital, and Illusian also engaging. The startup has raised a total of $19.9 million. EU-Startups has more here.

SenseNet, a six-year-old Vancouver startup that detects wildfires early using AI cameras, gas sensors, and satellites, raised a $14 million Series A round led by Stormbreaker, with Thin Line Capital, Fusion Fund, Plaza Ventures, FOLD36 Capital, and B Current Impact Investment also investing. More here.

VitriVax, a nine-year-old Boulder startup that develops vaccine formulations designed to eliminate cold-chain storage and enable single-dose immunizations, raised a $17.25 million Series B round co-led by Adjuvant Capital and RA Capital Management. CityBiz has more here.

Wonder Studios, a London startup founded this year that uses AI to produce commercial, partnered, and original entertainment content, raised a $12 million seed round led by Atomico, with LocalGlobe, Blackbird, and Adobe Ventures also participating. The Wall Street Journal has more here.

WSense, an eight-year-old Rome startup that develops underwater wireless systems enabling real-time communication among ocean sensors and autonomous vehicles, raised an $11.6 million pre-Series B round co-led by Indico Capital Partners and SIMEST, with CDP Venture Capital SGR, Blue Ocean by SWEN, RunwayFBU, Axon Partners Group, Fincantieri, and Rypples also opting in. The company has raised a total of $27+ million. Tech.eu has more here.

Smaller Fundings

Ampa, a three-year-old Palo Alto startup that is developing a portable, camera-guided transcranial magnetic stimulation system for major depressive disorder, raised an $8.5 million pre-A round led by Nexus NeuroTech Ventures, with Satori Capital, Morningside Ventures, Continuum Health Ventures, and the Zabara Foundation also participating. The company has raised a total of $18 million. Medical Device Network has more here.

Bricklayer AI, a two-year-old startup based in Arlington, VA, that develops AI-driven tools for automating security operations centers, raised a $5 million seed round. Tech Square Ventures was the deal lead, with Sovereign’s Capital and Dreamit Ventures also taking part. The startup has raised a total of $7.5 million. More here.

Coolant, a three-year-old startup based in Cambridge, MA, that builds spatial AI tools to help landowners and governments monitor and optimize their land and natural resources, raised a $4.3 million in seed and pre-seed funding co-led by General Catalyst and Floodgate, with Wicklow Capital and Ponderosa Ventures also participating. More here.

Natural, a one-year-old San Francisco startup that builds payment infrastructure for AI agents to autonomously execute transactions, raised a $9.8 million seed round. Abstract and Human Capital co-led the deal, with Forerunner Ventures, Terrain, Restive Ventures, and Genius Ventures also investing. More here.

OneAM, a one-year-old New York startup that provides a B2B working capital platform helping small and midsize businesses accelerate payment cycles by turning accounts receivable into cash, raised a $4.7 million seed round led by TTV Capital, with Correlation Ventures, and ThirdStream Partners also chiming in. More here.

Pavewise, a three-year-old startup based in Bismarck, ND, that provides real-time analytics and compliance automation for road construction projects, raised a $2.5 million seed round led by C2 Ventures, with Connectic, Service Provider Capital, M25, gener8tor 1889, and Broadwater Capital also piling on. More here.

Paygentic, a one-year-old San Francisco startup that builds flexible billing and payments infrastructure for AI-native and agent-driven products, raised a $2 million pre-seed round led by MiddleGame Ventures, with Anamcara Capital, Aperture Capital, and Tech Operators also stepping up. Tech Funding News has more here.

Smartbax, a four-year-old Munich startup that develops small-molecule antibiotics to combat multi-drug resistant bacteria, raised a $5.5 million pre-Series A round. Anobis Asset and Bayern Kapital were the co-leads, with UnternehmerTUM Funding for Innovators, HTGF, and Boehringer Ingelheim Venture Fund also anteing up. EU-Startups has more here.

Tensormesh, a San Francisco startup founded this year that helps AI developers boost inference efficiency by reusing key-value caches between model queries, raised a $4.5 million seed round led by Laude Ventures. TechCrunch has more here.

Wolf Games, a Los Angeles startup founded this year that develops narrative games using a proprietary AI engine, raised a $9 million Series A round. Main Street Advisors was the deal lead. Deadline has more here.

Sponsored By …

Raise the bar on fundraising. Successful fundraising begins with the right equity strategy. Fidelity’s latest guide will help you learn how to streamline your equity management and avoid common pitfalls. Learn key equity concepts like ownership and dilution and how to optimize your cap table and data room to connect with investors more effectively. Download the guide.

New Funds

Burnt Island Ventures, a five-year-old New York VC firm that backs early-stage startups developing critical water technologies, raised $50 million for its second fund. Tech Funding News has more here.

Exits

OpenAI announced today that it has acquired Software Applications, the two-year-old San Francisco startup behind Sky, an unreleased AI assistant for Macs that can view a user’s screen and take actions across apps via natural language commands. Terms were not disclosed. TechCrunch has more here.

People

President Trump backed off plans to deploy the National Guard in San Francisco after calls from Nvidia’s Jensen Huang, Salesforce’s Marc Benioff, and San Francisco Mayor Daniel Lurie, a reversal that highlights the city’s AI-fueled economic rebound. (We definitely talk about this with Mayor Lurie next week at Disrupt!) TechCrunch has more here.

On a Tesla earnings call with analysts yesterday, Elon Musk said he needs a proposed $1 trillion pay package in order to maintain control over a “robot army” he envisions Tesla building. TechCrunch has more here.

Layoffs

Rivian is cutting about 600 employees, or 4% of its workforce, in its third round of layoffs this year as it struggles to sustain sales ahead of its planned R2 SUV launch in 2026. TechCrunch has more here.

Post-Its

Essential Reads

Synthesia, an eight-year-old London company that creates hyper-realistic AI-generated video for corporate and creative uses, rejected a $3 billion takeover offer from Adobe and is reportedly eyeing a new funding round at a similar valuation. The Times has more here.

One day after Bloomberg reported that Kalshi is looking to raise a round at a $10+ billion valuation, the outlet is now saying that Polymarket is in the market to raise a round at a $12 billion to $15 billion valuation. More here.

Europe’s startup ranks are swelling, but founders say fragmented rules and heavy bureaucracy still choke cross-border expansion, sharpening calls for a single capital market, faster permitting, and simpler compliance to keep pace with the U.S. and China. The New York Times has more here.

Eight Sleep rolled out a new “outage mode” that lets users control its smart beds via Bluetooth after an AWS crash left thousands unable to adjust temperature or position. The Verge has more here.

Microsoft has a new Clippy. TechCrunch has more here.

Detours

Mentalist Oz Pearlman is pivoting into the business world with a new book that packages his mind-reading tricks as networking and persuasion tactics for ambitious founders and dealmakers.

While his teammates rake in NIL money, Texas A&M’s Swedish tight end is on a European visa and can’t collect a cent.

Brain Rot

Retail Therapy

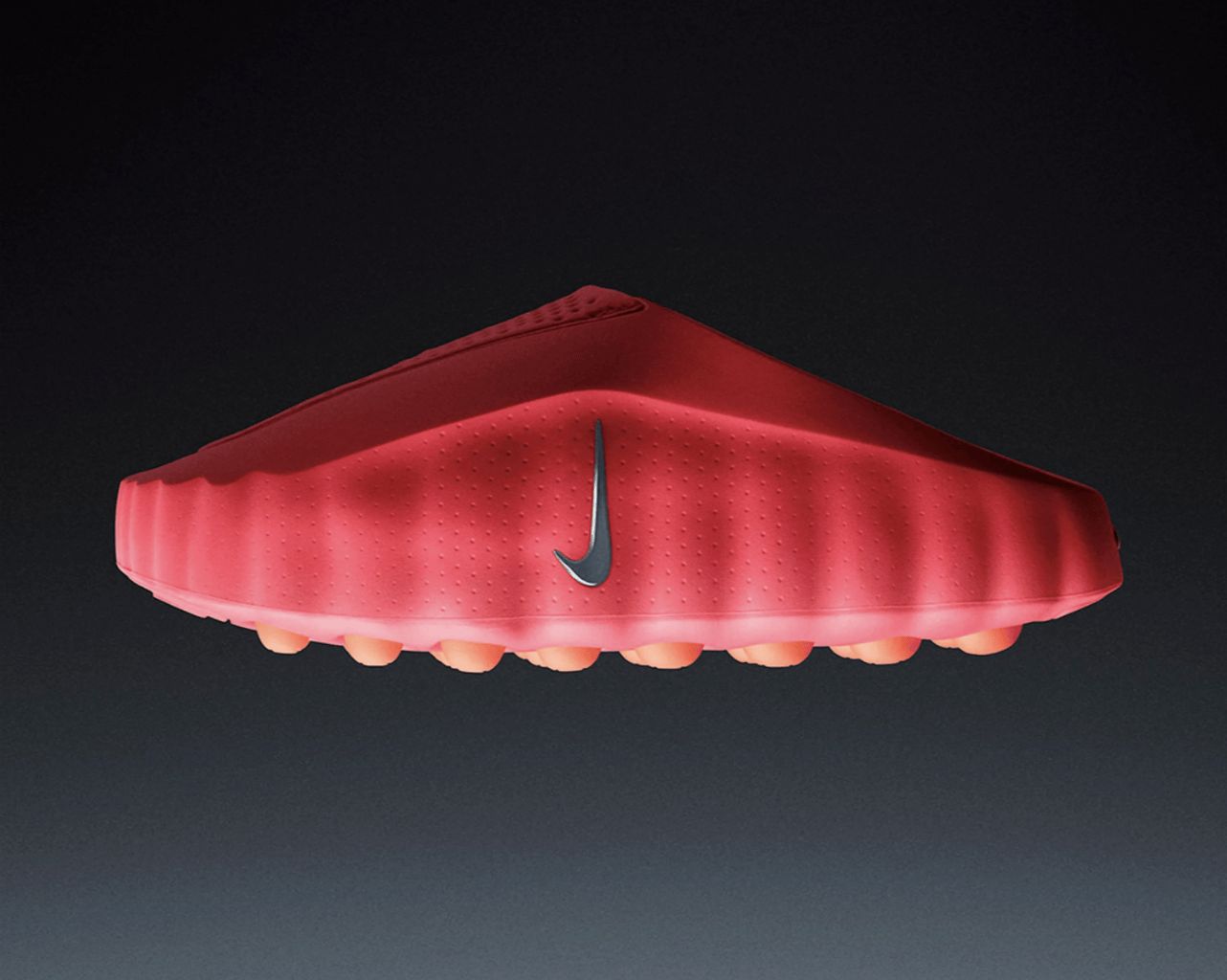

Image Credits: Nike

“Neuroscience-based footwear” from Nike.

Rivian spinoff Also has unveiled its first e-bike, the $4,500 TM-B, which swaps a traditional drivetrain for a pedal-by-wire system and blurs the line between a bicycle and an EV.

Tips (the non-pecuniary kind)

Please send all of your hot gossip to [email protected] or [email protected].

Want to advertise on StrictlyVC?

To book ads directly, contact us at [email protected].