Top News

YouTube told a California jury it is an entertainment platform like Netflix, not addictive social media, as a landmark trial tests whether product design can cause tech addiction and expose platforms to damages or forced design changes. The New York Times has more here.

On Tuesday night, Elon Musk gathered the employees of xAI for an all-hands meeting. Evidently, he wanted to talk about the future of his AI company, and specifically, how it relates to the moon.

Sponsored By …

Still copy-pasting data from portfolio updates? PortfolioIQ turns messy updates into clean, comparable portfolio data.

Upload what your PortCos already send - emails, spreadsheets, PDFs, decks, images. PortfolioIQ extracts, standardizes, and structures everything with 100% accuracy.

Discover how leading funds are already saving 500+ hours a year with PortfolioIQ.

VC Masha Bucher, Epstein Associate and Day One Founder, Explains Herself

Image Credits: Day One Ventures

By Julie Bort

Masha Bucher, a Silicon Valley VC and founder of Day One Ventures, took to X this week to address news reports documenting her close business and personal relationship with convicted sex offender Jeffrey Epstein. Bucher’s name — primarily under her maiden name, Masha Drokova — appeared in the latest dump of Epstein files over 1,600 times, The San Francisco Standard reported.

“He made me feel I could be safe from the regime, someone with power and connections who could shield me” from threats she associated with her home country Russia, which she said she feared after she obtained her U.S. green card, she wrote in the post.

“I was naive; I didn’t dig deep enough early on,” she wrote about why she agreed to work with Epstein. “I believed his story that his earlier conviction was about sleeping with a girl who lied about her age and trusted validations from multiple investors and scientists.” She also apologized to her founders, team, and investors, saying that this situation has “caused pain I never intended.”

The files paint a picture of how Bucher — whose Silicon Valley career began in social media and public relations — agreed to become Epstein’s publicist in 2017, helping rehabilitate his reputation after his 2008 sex-trafficking conviction and setting up meetings between him and various journalists, as Forbes reported.

The documents show that Epstein supported and encouraged her in the early days of Day One Ventures. The firm has since grown substantially — as Bucher told TechCrunch, it closed its most recent fund, a $150 million third vehicle, in 2024, bringing its assets under management to $450 million.

Some of the most salacious details from the emails involve Epstein giving her money and a Prada bag, and on one occasion, asking her for nude photos — though there’s no indication whether she complied — according to SFGate. Bucher is certainly a well-known VC in the Valley, having backed breakout companies like Superhuman, Remote, Worldcoin, and Truebill (which exited to Rocket Companies in 2021), as well as others like Valar Atomics.

The whole episode is a particularly awkward one for a VC whose whole spiel to founders is that she’s a PR expert who can help them with their public image. But it’s not Bucher’s first run-in with controversy.

Massive Fundings

Bretton AI, a two-year-old San Francisco startup that automates investigations and decision-making for anti-money laundering, know-your-customer, and sanctions reviews, raised a $75 million Series B round led by Sapphire Ventures, with TIAA Ventures as well as previous investors Greylock, Thomson Reuters Ventures, Canvas Ventures, and Y Combinator also contributing. More here.

Entire, a San Francisco startup founded last year that offers open source tools to manage and review code generated by AI agents, raised a $60 million seed round at a $300 million valuation. The deal was led by Felicis, with Madrona, M12, and Basis Set also investing. TechCrunch has more here.

Multiverse Computing, a seven-year-old startup based in San Sebastian, Spain, that develops software to shrink large language models so that they run with less energy and compute, is reportedly in talks to raise about €500 million in new funding at a €1.5+ billion valuation. Bloomberg has the scoop here.

Naboo, a four-year-old Paris startup that provides software to help enterprises book, manage, and control spending on corporate events, raised a $70 million Series B round led by Lightspeed Venture Partners, with Notion Capital, ISAI, and Ternel also anteing up. Tech Funding News has more here.

Runway, an eight-year-old New York startup that offers AI video-generation tools, raised a $315 million Series E round at a $5.3 billion post-money valuation. The deal was led by General Atlantic, with Nvidia, Fidelity, AllianceBernstein, Adobe Ventures, Mirae Asset, Emphatic Capital, Felicis, Premji, and AMD Ventures also opting in. TechCrunch has more here.

Solace Health, a four-year-old startup based in Redwood City, CA, that connects patients with healthcare advocates to help navigate diagnoses, care coordination, and insurance approvals, raised a $130 million Series C round at a $1+ billion post-money valuation. The deal was led by IVP, with Menlo Ventures, SignalFire, Torch Capital, Inspired Capital, and RiverPark Ventures also participating. MobiHealthNews has more here.

Tem, a five-year-old London startup that runs an AI-driven electricity trading platform that buys power directly from generators and sells it to businesses at prices closer to wholesale rates, raised a $75 million Series B round at a $300+ million post-money valuation, according to TechCrunch. The deal was led by Lightspeed Venture Partners, with AlbionVC, Allianz, Atomico, Hitachi Ventures, Revent, Schroders Capital, and Voyager Ventures also piling on. TechCrunch has more here.

Vega, a two-year-old New York startup that provides security analytics for detection and response without centralizing enterprise data, raised a $120 million Series B round led by Accel, with Cyberstarts, Redpoint, and CRV also engaging. The company has raised a total of $185 million. TechCrunch has more here.

Big-But-Not-Crazy-Big Fundings

Backslash Security, a four-year-old Tel Aviv startup that secures vibe coding and AI-driven application development workflows, raised a $19 million Series A round led by Kompas VC, with Artofin Venture Capital, First Rays Capital, Maniv, and StageOne Ventures also taking part. The company has raised a total of $27 million. SecurityWeek has more here.

Circit, an 11-year-old Dublin company that provides audit confirmations and financial data verification through a global, API-driven network, raised a $22 million round led by Ten Coves Capital, with previous investors Aquiline and MiddleGame Ventures also pitching in. CPA Practice Advisor has more here.

Equal Parts, a one-year-old Austin startup that acquires independent insurance agencies and supports them with shared technology and operations, raised a $23 million Series A round led by Inspired Capital, with Equal Ventures, Max Ventures, and Genius Ventures also taking stakes. PYMNTS has more here.

Galux, a six-year-old Seoul startup that provides AI-driven protein design tools for drug discovery, raised a $29 million Series B round. Investors included Yuanta Investment, Korea Development Bank, SL Investment, NCORE Ventures, SneakPeek Investments, Korea Investment & Securities, and Mirae Asset Securities as well as prior backers InterVest, DAYLI Partners, and PATHWAY Investment. The company has raised a total of $47 million. More here.

Hauler Hero, a six-year-old New York startup that provides all-in-one software for waste haulers covering CRM, billing, routing, and fleet visibility, raised a $16 million Series A round led by Frontier Growth, with K5 Global and Somersault Ventures also taking part. The company has raised a total of $27+ million. TechCrunch has more here.

Kainova Therapeutics, an 18-year-old Montreal company that develops treatments for cancer and inflammatory diseases, raised a $23.6 million Series B round led by Investissement Québec, with previous investors CTI Life Sciences, Panacea Venture, 3B Future Health Fund, Seventure Partners, Viva BioInnovator, Turenne Capital, Schroders Capital, adMare BioInnovations, and Seido Capital also digging in. More here.

ManageMy, an eight-year-old UK startup whose software helps insurers sell, service, underwrite, and manage policies, raised a $20.5 million Series B round led by Ventura Capital, with OCVC and BNF also engaging. BusinessCloud has more here.

Matia, a three-year-old Miami startup that provides data management infrastructure designed to support AI-driven systems, raised a $21 million Series A round led by Red Dot Capital Partners, with previous investors Leaders Fund, Caffeinated Capital, Cerca Partners, Secret Chord Ventures, and VelocityX also stepping up. CTech has more here.

Natilus, a 10-year-old San Diego company that designs blended-wing aircraft for cargo and passenger transport, raised a $28 million Series A round led by Draper Associates and including Type One Ventures, The Veterans Fund, Flexport, New Vista Capital, Soma Capital, Liquid 2 VC, VU Venture Partners, and Wave FX. More here.

Newo, a three-year-old San Francisco startup that builds AI-powered voice and text agents to act as always-on front desk personnel for small and midsize businesses, raised a $25 million Series A round led by Ratmir Timashev, with Aloniq, Constructor.io, Acrobator Ventures, and s16vc also participating. The company has raised a total of $32 million. SiliconANGLE has more here.

Pandorum Technologies, a 15-year-old Bengaluru company that develops regenerative therapies for inflammatory and degenerative diseases, raised an $18 million Series B round led by Protons Corporate, with Galentic Pharma, Ashish Kacholia, Noblevast Advisory, Avinya Fund, and the Burman Family also joining in. More here.

Reco, a six-year-old New York startup that monitors and controls how employees and AI tools access and use enterprise SaaS applications, raised a $30 million Series B round led by Zeev Ventures, with Workday Ventures, TIAA Ventures, S Ventures, and Quadrille Capital as well as previous investors Insight Partners and boldstart ventures also pitching in. The company has raised a total of $85 million. CTech has more here.

Simple AI, a two-year-old San Francisco startup that builds voice-based AI agents to handle inbound sales and support calls for consumer brands, raised a $14 million seed round led by First Harmonic, with Y Combinator, Massive Tech Ventures, and True Ventures also participating. More here.

Somethings, a five-year-old New York startup that connects teens and young adults with trained peer mentors for mental health support, raised a $19.2 million Series A round led by Catalio Capital, with previous investors General Catalyst and Tusk Ventures also investing. More here.

Trener Robotics, a two-year-old San Francisco startup that develops AI software to train and run industrial robots through natural language and simulation, raised a $32 million Series A round co-led by Engine Ventures and IAG Capital Partners, with Cadence and Geodesic Capital also stepping up. Design Engineering has more here.

Smaller Fundings

Allonic, a Budapest startup founded this year that operates a manufacturing platform for producing advanced robotic limbs through automated, assembly-free processes, raised a $7.2 million pre-seed round led by Visionaries Club, with Day One Capital, PROTOTYPE, RoboStrategy, SDAC Ventures, and Tiny Supercomputer Investment Company also participating. AI Insider has more here.

The Bland Company, a two-year-old UK startup that uses chemistry to turn leftover plant material from food and agriculture production into highly functional proteins that can replace eggs in baked goods and other foods, raised a $2.67 million pre-seed round led by Initialized Capital, with additional support from Entrepreneur First, Transpose Platform, Behind Genius Ventures, Alumni Ventures, and Vento. AgFunderNews has more here.

Dono, a three-year-old startup based in Tel Aviv and West Palm Beach, FL, that provides AI-powered infrastructure for verifying and structuring property records, raised a $6.5 million seed round led by Link Ventures, with lool VC and Alumni Ventures Group also chipping in. SiliconANGLE has more here.

Smart Bricks, a two-year-old San Francisco startup that seeks to enable automated discovery, underwriting, and execution of global real estate investments, raised a $5 million pre-seed round led by Andreessen Horowitz, with Techstars, 500 Global, Cornerstone VC, South Loop Ventures, Harvard Business School Alumni Angels, and Cento Ventures also piling on. TechCrunch has more here.

Topview, a four-year-old Singapore startup whose software lets teams collaboratively generate text, images, voice, and video in a single AI-powered workspace, closed a $5.5 million tranche of a $14 million Series A round. Kamet Capital was the deal lead. More here.

Veritas, a recently founded San Francisco startup that seeks to embed tamper-resistant NFC chips and linked digital certificates into luxury goods to verify authenticity and combat counterfeits, raised a $1.75 million pre-seed round led by Seven Seven Six. TechCrunch has more here.

xWatts, a four-year-old London startup that uses AI to directly control and optimize energy systems in large buildings such as hospitals, universities, and industrial sites, raised a $2.2 million seed round led by Cambridge Enterprise Ventures and including Cambridge Angels, Parkwalk, and R42. Tech Funding News has more here.

ZeroDrift, a New York startup founded this year whose software automatically checks outbound emails, posts, and client communications for regulatory compliance, raised a $2 million pre-seed round led by Andreessen Horowitz. Tech Funding News has more here.

Sponsored By …

Portfolio Data for the AI Era

Visible centralizes your portfolio data in one platform, no chasing metrics, no manual follow-ups. With 50% of portfolio metrics now created using AI, investors on Visible are moving from insight to action faster than ever. See why 950+ VCs trust Visible.

New Funds

Primary Ventures, an 11-year-old New York VC firm that focuses on seed and pre-seed investing across sectors including consumer, fintech, healthcare, enterprise, and AI, raised a $625 million fifth fund. TechCrunch has more here.

Going Public

Kraken, a San Francisco crypto exchange that operates a global digital asset trading platform, has moved CFO Stephanie Lemmerman into a strategic advisory role as it prepares for a long-anticipated U.S. IPO. Robert Moore, previously the company’s VP of business expansion, has effectively taken over the role and is now listed as deputy CFO. CoinDesk has more here.

People

With co-founders Tony Wu and Jimmy Ba departing yesterday and today, exactly half of xAI’s twelve founding members have now exited, deepening leadership churn as the company heads toward an IPO. TechCrunch has more here.

OpenAI fired product policy vice president Ryan Beiermeister in January over alleged sexual discrimination after she opposed the planned launch of erotic content in ChatGPT, a move that has intensified internal debate over safety, monetization, and adult features. The Wall Street Journal has more here.

Post-Its

Essential Reads

KPMG pushed its own auditor, Grant Thornton UK, to cut its fees by 14%, arguing that AI should lower audit costs, a move that could provide clients with fresh leverage in pricing talks across the industry. The Financial Times has more here.

There may be a lot of rumors flying around about OpenAI’s first hardware device, but one thing is clear: it won’t ship until at least February of next year. Wired has more here.

Bloomberg reports that Andreessen Horowitz has become a central force shaping Trump-era AI policy, with White House officials routinely consulting the firm as it spends heavily to lobby for minimal regulation that benefits its AI portfolio companies and allies. More here.

Google turned over extensive personal and financial data on a student journalist to ICE in response to an administrative subpoena that lacked judicial approval, raising the question of whether tech companies will now begin to hand over user data without a judicial warrant. TechCrunch has more here.

A Stanford graduate student’s matchmaking app, Date Drop, has paired more than 5,000 students through an algorithmic questionnaire, turning campus dating into a weekly ritual. The Wall Street Journal has more here.

Detours

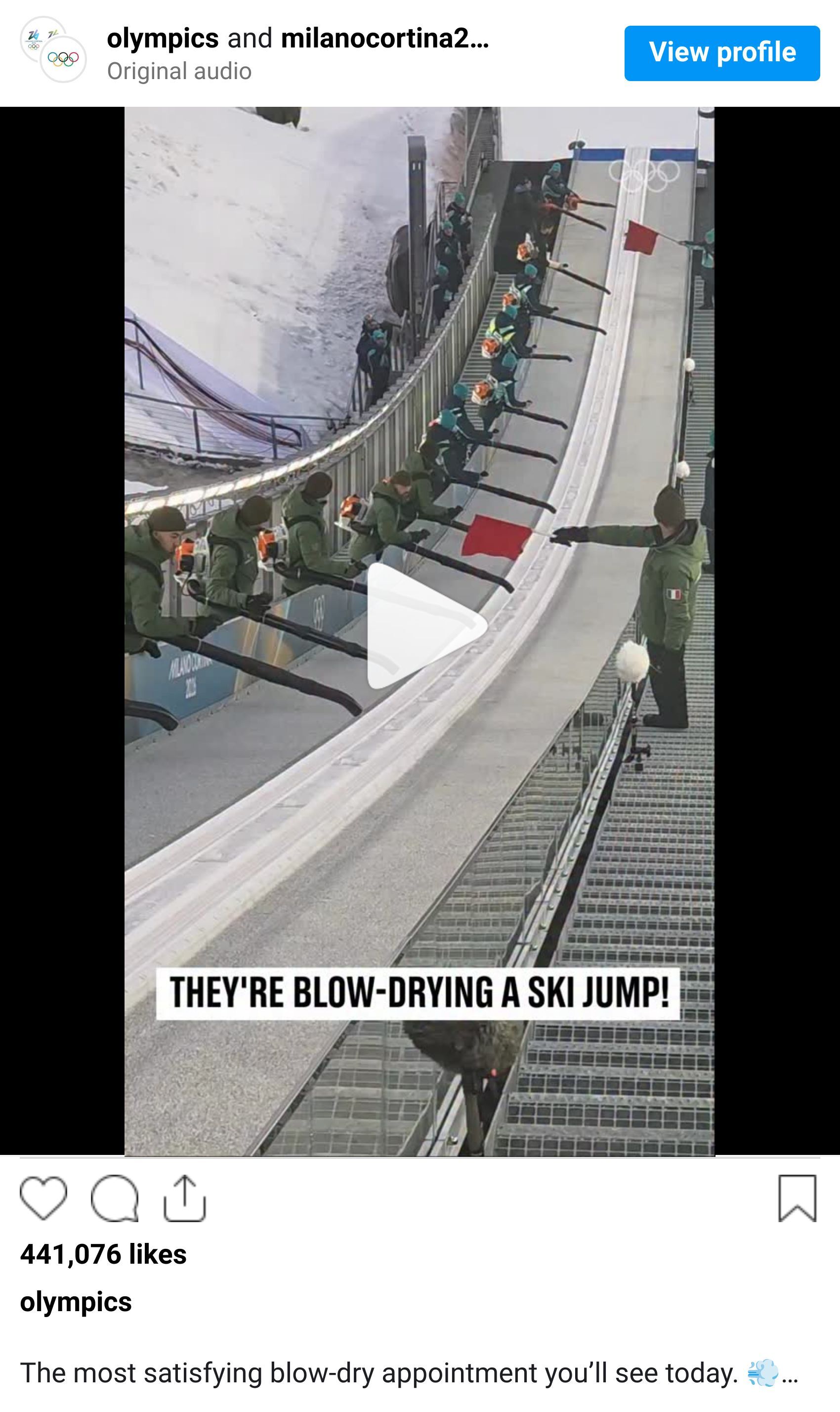

A Czech sibling ice dance duo drew attention at the Olympics after skating part of its rhythm dance to AI-generated music meant to sound like 1990s rock.

Olympic medals at the Milan Cortina Games are already failing, with athletes reporting ribbons detaching and medals dropping to the ground just days into competition.

Brain Rot

Retail Therapy

Cordova Woodworking is reviving the TV as furniture with a midcentury-style cabinet that hides a 32” flat screen, soundbar, and gaming consoles.

Tips (the non-pecuniary kind)

Please send all of your hot gossip to [email protected] or [email protected].

Want to advertise on StrictlyVC?

To book ads directly, contact us at [email protected].